Charitable Assets Under Administration Accounts

The Community Foundation now offers organizations a specialized and local option for reserve investment.

The Community Foundation now offers organizations a specialized and local option to help grow their reserves by pooling funds with our diversified and professionally-managed portfolio. As an institutional investor, our well-balanced investment pool has the potential for greater growth than many term deposits and unlike many GICs, you have the flexibility and peace of mind to withdraw the funds at anytime. The funds remain under your ownership, but the Charitable Assets Under Administration (CAUA) program allows you to benefit from significant economies of scale with the potential for lower fees and higher returns. For the Community Foundation, our goal is to help organizations to grow reserves and harness the strength of our investment portfolio to add extra dollars to your bottom line.

The South Saskatchewan Community Foundation’s CAUA program provides expertise and guidance in managing funds raised through Run Regina’s events.

The diversified investment portfolio reduces market volatility, and the Foundation ensures that our funds are managed responsibly with low administrative fees, growing steadily to support our future initiatives. We have easy access to detailed financial statements through an online portal, which allows us to monitor the performance of our investments.

This partnership allows Run Regina to focus on our mission to engage our community in running and walking experiences that promote the wellbeing of the individual and pride in our community, while knowing their assets are in safe, capable hands—helping to create a lasting positive impact in Saskatchewan.

Cari Bode

Chair of the Run Regina Finance & Audit Committee

The Saskatchewan Archeological Society (SAS) shifted our long-term investments to a Community Foundation in 2018. One was because the rate of return was higher and the fees were lower. More importantly though, we now had the peace of mind that experts were managing our funds and we could be assured they were making informed financial decisions. We are provided easy to understand quarterly reports and we can access our funds when needed, with no penalty. It’s a comfort knowing our funds are being looked after by [a Community Foundation] and the fees are helping to support the non-profit sector.

Dr. Tomasin Playford

Executive Director, Saskatchewan Archeological Society

Ready to get started?

Charity Partnership Booklet: Empowering Your Impact

Report on Investment Results

Benefits From Economies of Scale

The Charitable Assets Under Administration Account is an opportunity designed to help your organization optimize its reserves through our diversified and expertly-managed investment pool while also providing full access to funds.

Professional, Expert Management

Expert third-party investment managers apply strategic insights to maximize returns while aligning with our Board-approved investment policy and financial objectives.

Maintain Control Over Funds

Your funds remain under your ownership and are accounted for on your financials. Retain control over your funds without sacrificing growth potential.

Diversified Investments

Our well-balanced investment portfolio reduces exposure to market volatility with investments in infrastructure, real estate, and mortgages alongside equities.

Full Transparency

In addition to quarterly financial statements, you will have access to a private online Fund Portal that chronicles contributions and withdrawals from your account.

Access Funds Anytime

Enjoy the flexibility and peace-of-mind knowing that you can withdraw funds at anytime without penalty. There is no holding period and no locked-in term.

Low Administrative Fees

The low fees charged by the Community Foundation as an institutional investor are cost-effective and ultimately go back to support the local charitable sector.

Establishing a Charitable Assets Under Administration account with the Community Foundation allows your organization to benefit from our economies of scale and expertise.

With over $125 million in assets, the Community Foundation stewards a diversified and professionally-managed portfolio that harnesses the power of investments to earn returns for our local charitable sector. Our goal is to support your financial sustainability and share our investment infrastructure to help grow your reserves.

Organizations can open a Charitable Assets Under Administration account with a minimum initial contribution of $10,000. You will receive quarterly financial statements from the Community Foundation, access to an online portal, and can withdraw funds at anytime. There are no hidden fees, no upfront fees for setup, and no fees or penalties for withdrawal.

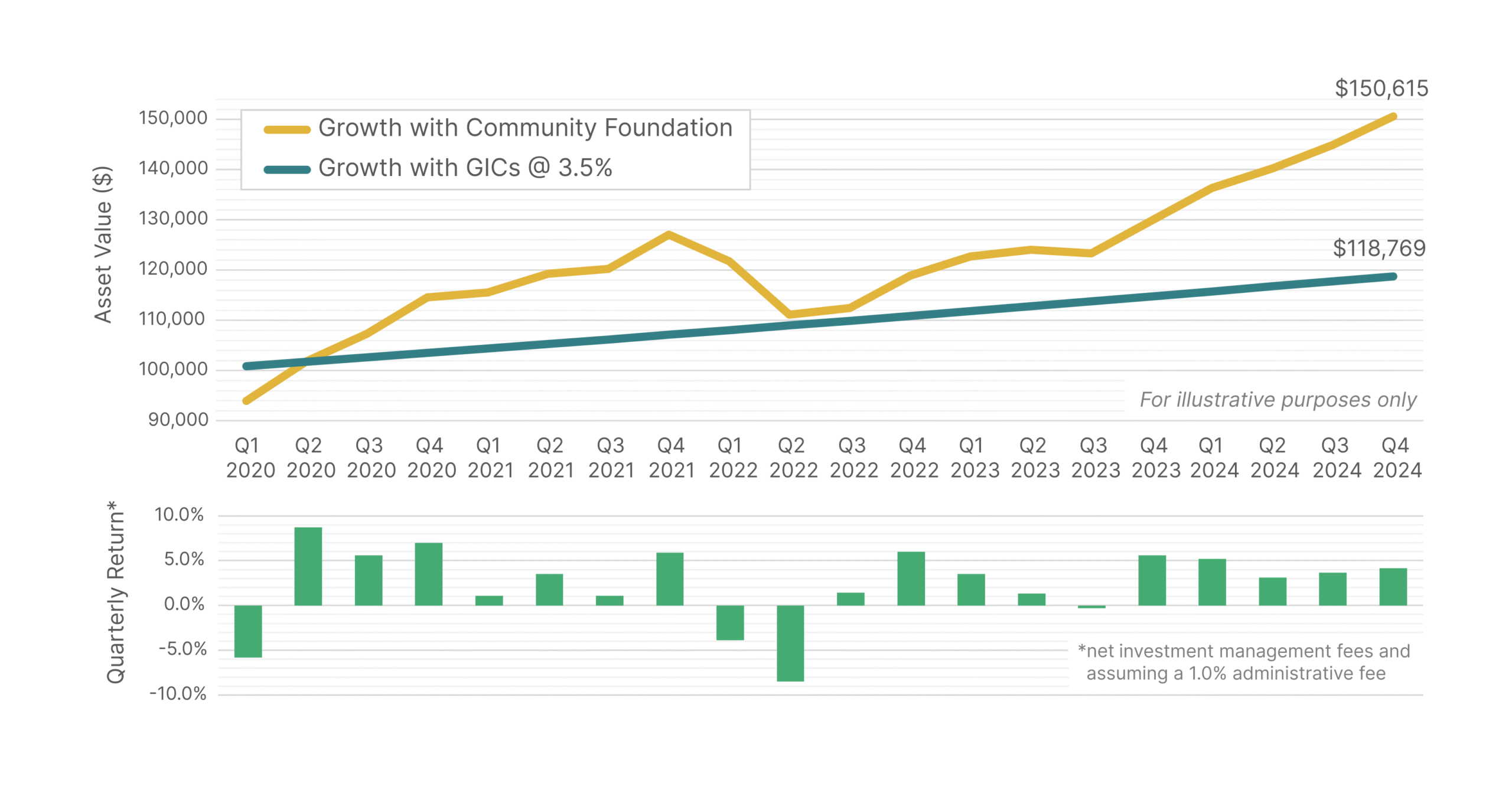

While quarterly returns do fluctuate, the Charitable Assets Under Administration program offers greater potential for long-term growth than term deposits with greater flexibility.

The figure below plots our quarterly returns for the past three years (green bars). Our fifteen-year historical average annualized return is now above 8.5% and our five-year average annualized return is above 10.0%, net investment management fees.

In the short-term, while there may be unrealized losses some quarters, the Community Foundation’s investment portfolio is designed with a long-term outlook, just like your own pension plan. The greatest risk of losses is in the short-term and the greatest opportunity for growth is in the long-term.

The top figure illustrates the potential growth for $100,000 in reserves if invested with the Charitable Assets Under Administration program (Yellow line) compared toa GIC (blue line).

After five years, the GIC value would be $118, 769 (assuming five consecutive 1-year terms at 3.5% interest). By comparison, the initial investment of $100,000 would have grown to $150,615 with the Community Foundation.

Even with occasional quarterly losses, the Community Foundation’s investment portfolio significantly outperforms a GIC in the long-term. Plus, you maintain the flexibility to withdraw at anytime without penalty.

Getting Started is Easy

1. Connect with us

Start a conversation with our team about the different fund types available to you, as well as the purpose of your fund. We’re always happy to present at Finance Committees and Board Meetings if your organization is wanting more information.

2. Board motion

The Board Motion documents the intentions of your organization to establish a fund or multiple funds with the Community Foundation. Suggested text for the Board Motion can be found below:

[Legal Name of Organization] wishes to establish [Type of Fund or Funds] at the Saskatchewan Community Foundation to support the operations of [Legal Name of Organization]. We approve of and authorize [Name, Title] to finalize the terms of the agreement(s) with the Saskatchewan Community Foundation.

3. Fund establishment

Our team will work with you to finalize the agreement(s), including the name of your Fund, your Fund purpose, and the value of your initial contribution. Once signed by all parties, we will start building your Fund webpage, setting up an online donation page, and giving you access to the Fund Portal.

Did you know we are one of seven Community Foundations within Saskatchewan?

Building partnerships, sharing ideas and working together for Saskatchewan communities. Large or small, we all support building community right where you live. Check out some of the wonderful impact that these foundations do within their communities!

Not quite sure where to start? We're here to help!

About the Community Foundation

Maximize Your Donations

Ways Donors Can Give

If you have any questions on how we can help empower your organization's impact, please feel free to reach out to our Community Engagement expert!

Stay Connected

Sign up to our email list today to ensure you never miss an opportunity to engage with the Community Foundation. We will send you updates on how the community is fairing with our Vital Signs reports, invitations to upcoming events, as well as our newsletters released twice a year.