Donate before the end of the year to a cause that you care deeply about and save on your taxes.

Donate stocks in 2023 before CRA rules change.

SSCF will complete the trades within one business day at the market value. This includes zero fees for stocks, bonds, or mutual funds.

When you donate through SSCF, your entire gain is tax-exempt.

You will receive a tax receipt for 100% of your stock trading price.

We process transactions within one business day. You will receive your tax receipt based on the transaction date.

As a trusted holder of endowed funds, your donation will be protected and the interest earned each year is provided to the charities and community causes that align with your values. Your donation will live on and grow forever.

Donate to an existing fund online.

Do you want to make your donation online to an existing fund? Scroll down to support your community through a focus area. You can find a variety of causes who are currently accepting online donations through SSCF who are aligned with specific focus areas.

Make your gift online by December 31 at 11:59 p.m. and receive a charitable tax receipt for that same tax year!

Support by Focus Area

If you want to support your community through a focus area, you can find a variety of causes who are currently accepting online donations through SSCF who are aligned with specific focus areas.

South Saskatchewan Vital Community Fund

The South Saskatchewan Vital Community Fund allows SSCF to respond to focus areas identified in its community research, including Vital Signs reporting and recommendations by the South Saskatchewan Vital Community Committee. This includes a focus area on drug abuse and addiction.

Your donation to this legacy fund will give back to the Regina Early Learning Centre programming for many years to come. You’re helping children in our community establish the foundation for a love of learning and setting them on a path for lifelong success, and at the same time helping their parents become the best parents they can be

Broncs Football Capital Project Fund

To commemorate our 75th Anniversary we are now launching another amazing capital project – The McCall Field Improvement Project. This multi-phase project will include an irrigation system, football field & track resurfacing, upgraded bleachers and permanent field lighting. This project will take place throughout 2023 and 2024.

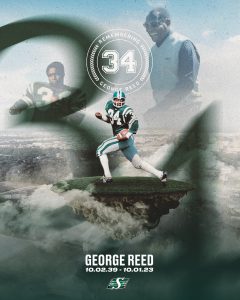

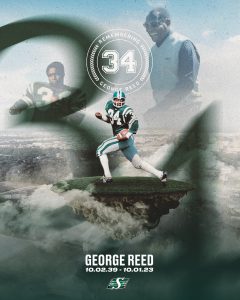

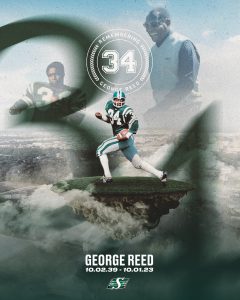

To continue #34’s remarkable legacy, the Saskatchewan Roughrider Foundation and George Reed Foundation recently joined together to create the George Reed Legacy Fund. This fund will ensure continued support for the causes that mean the most to Reed for years to come: Special Olympics Saskatchewan and Mother Teresa Middle School.

Saskatchewan Roughrider Foundation

The Saskatchewan Roughrider Foundation is a product of the commitment the club has made to our province’s communities. With a dedication to the future, the Foundations mission is to empower youth of the province by teaching them skills like leadership, resilience, and responsibility! Our efforts are focused through the three main pillars of Education, Health and Amateur Football so the youth of Saskatchewan have the opportunity to reach their full potential, achieve their goals and ultimately be a part of creating a brighter future for Saskatchewan.

Supporting the YMCA means supporting your neighbours – individuals, children and families in our community, across all generations regardless of their means and abilities. The YMCA ensures a better quality of life for all our neighbours, a safer and more engaged community, and a brighter future for kids and families.

Carlyle Community Complex Fund

A donation to this Fund is to raise funds for additional space requirements in a new PreK-Grade Twelve school and multi phase community center. You will receive a tax receipt for your donation.

To continue #34’s remarkable legacy, the Saskatchewan Roughrider Foundation and George Reed Foundation recently joined together to create the George Reed Legacy Fund. This fund will ensure continued support for the causes that mean the most to Reed for years to come: Special Olympics Saskatchewan and Mother Teresa Middle School.

Saskatchewan Roughrider Foundation

The Saskatchewan Roughrider Foundation is a product of the commitment the club has made to our province’s communities. With a dedication to the future, the Foundations mission is to empower youth of the province by teaching them skills like leadership, resilience, and responsibility! Our efforts are focused through the three main pillars of Education, Health and Amateur Football so the youth of Saskatchewan have the opportunity to reach their full potential, achieve their goals and ultimately be a part of creating a brighter future for Saskatchewan.

Desirée Hutton (née Steele) Legacy Fund

The Desirée Hutton (née Steele) Legacy Fund supports community service-oriented learners and students in the first generation of their family to seek post-secondary education. Donations to this Endowed Fund grow over time and will benefit charitable causes for many years to come.

Donavon Puttick Memorial Scholarship Legacy Fund

The Donavon Puttick Memorial Scholarship was established in honour of Donavon Puttick, who lost his battle with mental illness at the age of 16.

Despite his own struggles, Donavon was known among his friends and family as someone who could be relied on to help talk others out from their own darkness or self-doubt. He was kind, fair, and perceptive to others emotions well beyond his 16 years.

In establishing this scholarship, Donavon’s mom hopes to help reduce stigma around mental illness by encouraging mental health awareness among our youth and supporting students who are active in this area.

Students will be selected by school staff based on demonstrated support of mental health awareness and/or initiatives. Involvement may be formal or informal. There is no requirement to be registered in post-secondary education.

The DEK All Nations Healing Hospital Foundation Fund

This Fund supports the delivery of safe, wholistic health services and research to meet the needs of individuals in Fort Qu’Appelle and the surrounding area through acute care services, women’s health, low-risk birthing, kidney care, and cultural and traditional services. This includes, but is not limited to, physician services, acute care beds, emergency services, access to traditional knowledge keeping, traditional medicine, and spiritual counselling.

Regina Paramedics with Heart Fund

A non-profit organization run by local paramedics to enhance paramedics’ quality of life through professional and community collaboration.

The Johnny Z Healthy Minds Fund

The Johnny Z Healthy Minds Fund has been created in memory of John Mark Ziegler to help others with trauma/grief counselling and mental health support – including laughter.

For the full story and more information on what we do, visit www.johnnyzfund.ca

South Saskatchewan Vital Community Fund

The South Saskatchewan Vital Community Fund allows SSCF to respond to focus areas identified in its community research, including Vital Signs reporting and recommendations by the South Saskatchewan Vital Community Committee. This includes a focus area on homelessness and affordable housing.

Ubuntu Community Resource Foundation – Legacy Fund and Development Fund

The objectives and goal of these funds are centered in the Universal Declaration of Human Rights (1948) – specifically in the “equality of human dignity and worth” of every human being, and it’s the other objects. The aim of these funds is focused on addressing systemic racism; and their work is informed by United Nations Educational, Scientific and Cultural Organization’s Declaration on Race and the Elimination of Racial Prejudice (1978). They also seek to effectively contribute to the goals of the UN International Decade for People of African Descent (2015-2024) – i.e., Recognition, Justice, and Development.

The fund is intended to address programs that will help advance the Truth & Reconciliation Calls to Action in the areas of Education, Culture and Language. For example, this may include opportunities for children, youth and families to reconnect to their culture by providing opportunities such as workshops, events, classes that offer individuals and families connection to Elders, communities, and the Land.

South Saskatchewan Vital Community Fund

The South Saskatchewan Vital Community Fund allows SSCF to respond to focus areas identified in its community research, including Vital Signs reporting and recommendations by the South Saskatchewan Vital Community Committee. This includes a focus area on racism towards new immigrants and Indigenous peoples.

The DEK All Nations Healing Hospital Foundation Fund

This Fund supports the delivery of safe, wholistic health services and research to meet the needs of individuals in Fort Qu’Appelle and the surrounding area through acute care services, women’s health, low-risk birthing, kidney care, and cultural and traditional services. This includes, but is not limited to, physician services, acute care beds, emergency services, access to traditional knowledge keeping, traditional medicine, and spiritual counselling.

Desirée Hutton (née Steele) Legacy Fund

The Desirée Hutton (née Steele) Legacy Fund supports community service-oriented learners and students in the first generation of their family to seek post-secondary education. Donations to this Endowed Fund grow over time and will benefit charitable causes for many years to come.

Donavon Puttick Memorial Scholarship Legacy Fund

The Donavon Puttick Memorial Scholarship was established in honour of Donavon Puttick, who lost his battle with mental illness at the age of 16.

Despite his own struggles, Donavon was known among his friends and family as someone who could be relied on to help talk others out from their own darkness or self-doubt. He was kind, fair, and perceptive to others emotions well beyond his 16 years.

In establishing this scholarship, Donavon’s mom hopes to help reduce stigma around mental illness by encouraging mental health awareness among our youth and supporting students who are active in this area.

Students will be selected by school staff based on demonstrated support of mental health awareness and/or initiatives. Involvement may be formal or informal. There is no requirement to be registered in post-secondary education.

The Johnny Z Healthy Minds Fund

The Johnny Z Healthy Minds Fund has been created in memory of John Mark Ziegler to help others with trauma/grief counselling, suicide prevention and mental health support – including laughter.

For the full story and more information on what we do, visit www.johnnyzfund.ca

The Kevin Tell Legacy Fund has been established in memory of Kevin Tell. Donations will support charitable purposes. Donations to this Endowed Fund grow over time and will benefit charitable causes for many years to come.

Robbie Curtis Memorial Scholarship

In his memory, the Curtis Family and Regina Paramedics with Heart have created the Robbie Curtis Memorial Scholarship. This scholarship will be awarded annually to a Paramedic who shares the same commitment to their job and future education that Robbie did. A one-time payment of $2000.00 will be paid to the educational institute that the scholarship winner is attending. The scholarship will be chosen by the Curtis Family and the Regina Paramedics with Heart Board of Directors.

Roberto’s family has created the Roberto Roman Memorial Fund to honour his life and his commitment to supporting his community. Donations to this legacy fund will grow and give back to charitable causes in Weyburn and surrounding communities, forever. This means his name, and his impact on those in need, will live on in perpetuity.

South Saskatchewan Vital Community Fund

The South Saskatchewan Vital Community Fund allows SSCF to respond to focus areas identified in its community research, including Vital Signs reporting and recommendations by the South Saskatchewan Vital Community Committee. This includes a focus area on mental health.

The Johnny Z Healthy Minds Fund

The Johnny Z Healthy Minds Fund has been created in memory of John Mark Ziegler to help others with trauma/grief counselling, suicide prevention and mental health support – including laughter.

For the full story and more information on what we do, visit www.johnnyzfund.ca

Big Sky Centre for Learning and Being Astonished!

We work towards inclusive community where young adults with complex physical disAbilities can share their dreams, explore their strengths, and lead others to a more authentically inclusive society. Operating on a user-led model, we address barriers and offer innovative services and programs in the areas of teaching and learning; social, recreational and cultural engagement; self discovery and vocation. Supporting Astonished means supporting inclusive community and meaningful opportunities for young adults experiencing complex physical disabilities.

To continue #34’s remarkable legacy, the Saskatchewan Roughrider Foundation and George Reed Foundation recently joined together to create the George Reed Legacy Fund. This fund will ensure continued support for the causes that mean the most to Reed for years to come: Special Olympics Saskatchewan and Mother Teresa Middle School.

Carlyle Community Complex Fund

A donation to this Fund is to raise funds for additional space requirements in a new PreK-Grade Twelve school and multi phase community center. You will receive a tax receipt for your donation.

South Saskatchewan Vital Community Fund

The South Saskatchewan Vital Community Fund allows SSCF to respond to focus areas identified in its community research, including Vital Signs reporting and recommendations by the South Saskatchewan Vital Community Committee. This includes a focus area on sustaining rural communities.

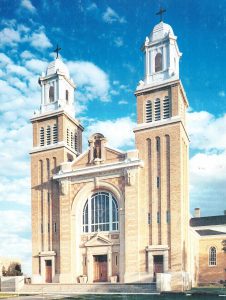

A donation to this Fund ensures the long-term preservation of the unique Gravelbourg Co-Cathedral for future generations. The donations or the capital in this endowed fund will remain in perpetuity; only the interest generated can be spent, and solely for the preservation of the Co-Cathedral.

Broncs Football Capital Project Fund

To commemorate our 75th Anniversary we are now launching another amazing capital project – The McCall Field Improvement Project. This multi-phase project will include an irrigation system, football field & track resurfacing, upgraded bleachers and permanent field lighting. This project will take place throughout 2023 and 2024.

To continue #34’s remarkable legacy, the Saskatchewan Roughrider Foundation and George Reed Foundation recently joined together to create the George Reed Legacy Fund. This fund will ensure continued support for the causes that mean the most to Reed for years to come: Special Olympics Saskatchewan and Mother Teresa Middle School.

Your donation to this legacy fund will give back to the Regina Early Learning Centre programming for many years to come. You’re helping children in our community establish the foundation for a love of learning and setting them on a path for lifelong success, and at the same time helping their parents become the best parents they can be

Regina Leader-Post Christmas Cheer Fund

Your 2022 donation to the Regina Leader-Post Christmas Cheer Fund will help four organizations shelter families from physical, sexual and emotional abuse. Donations will be shared equally by: SOFIA House, Transition House, Isabel Johnson Shelter, and WISH Safe House.

Supporting the YMCA means supporting your neighbours – individuals, children and families in our community, across all generations regardless of their means and abilities. The YMCA ensures a better quality of life for all our neighbours, a safer and more engaged community, and a brighter future for kids and families.