Wills ~

Wills ~

Today's preparation, tomorrow's legacy.

Today's preparation, tomorrow's legacy.

A Will is more than a document; it’s a final act of love and responsibility, ensuring your legacy lives on and your life’s story is told as you wish. Gift giving through a Will or an estate allows you to provide ongoing support, inspiration, and impact to the causes you care about most, forever. A gift in your Will may specify a sum of money, a specific asset, or a portion of your estate to be donated to the Community Foundation or an existing Fund at the Community Foundation.

We are happy to work directly with families, charities, corporations, and professional advisors to ensure your legacy is preserved as you wish; even if your generosity is preferred to remain anonymous, the possibilities are endless.

When to Start Thinking About Wills

When to Start Thinking About Wills

Planning your Will is relevant during all stages of life, not just when you’re planning for post retirement. In fact, within Saskatchewan you can complete your Will as early as 18 (as long as you are sound of mind)! The real question is, when should you begin thinking about your Will? This is a tricky question whose answer really depends on the situation of the individual asking. Most people tend to consider creating or updating their Will once larger milestones are achieved, but this isn’t the only time you should be taking your Will into consideration. If you have children or pets, you have an inheritance being left to you, or you have an idea on where your assets will go (family, charity, etc.), these are all valid reasons for you to think about creating a Will or updating your existing one.

One-Time or Forever Gift?

One-Time or Forever Gift?

Many people have charities that they regularly support. The amounts may not be large. But from the charity’s point of view, “It’s not the size of the gift but the giving that counts.” Those donations might be larger if…

Too Young To Think About Making A Will? Maybe Not.

Too Young To Think About Making A Will? Maybe Not.

I’m often asked by friends and colleagues, “when should I prepare my first Will?” While there is no one size fits all answer, there are a number of factors and considerations that can help…

Benefits of Bequests

Benefits of Bequests

Control Over Asset Distribution

Without a Will, your assets are distributed according to provincial laws, which may not align with your personal wishes. A Will allows you to decide precisely who inherits what, ensuring your assets go to the people or causes you care most about.

Protection for Loved Ones

A Will can provide financial security and clear instructions for the care of your dependents, including minor children. It allows you to appoint guardians, reducing the risk of disputes or uncertainty about their future welfare.

Minimize Legal Complications and Costs

A well-crafted Will simplifies the legal process for your heirs, potentially reducing the time and expenses associated with settling your estate. This can be a significant relief during a time of grief.

Reflect Your Values and Wishes

A Will is a powerful tool to express your values, be it through charitable donations, personal bequests, or specific funeral arrangements. It’s an opportunity to leave a lasting impact that aligns with your beliefs and life story.

The Taxman Cometh – WILL you be prepared?

The Taxman Cometh – WILL you be prepared?

Is it time to start thinking about your WILL?

The past pandemic and current global capital markets have more people than ever thinking about their legacy, longevity, and tax bills now and at the time of their passing. Proper planning through your estate can increase charitable intent and reduce income tax…

Saskatchewan Estate Law 101: Here’s What You Need to Know About Wills & Estates

Saskatchewan Estate Law 101: Here’s What You Need to Know About Wills & Estates

Your quick start guide to Saskatchewan Wills: From the beginner basics to making your own!

Hey Saskatchewaners,

Looking for Saskatchewan estate law help? Aren’t we all…

See How Bequests Have Impacted Your Community

See How Bequests Have Impacted Your Community

Getting Started

Getting Started

Here at the Community Foundation, we are experts in the many ways of giving. We harness your gifts of donations and resources to help build legacies all across Saskatchewan. On your behalf, we handle all the details of your valued donation. Not only do we provide guidance to individuals, we bring opportunities for businesses to partake in employee giving campaigns and point-of-sales donations as well.

Many charities, especially smaller ones, do not have the expertise or capacity to handle unique donations. In working with the Community Foundation, you can let the charities you love focus on what they do best, and in working with us, you can ensure they receive sustainable funding forever through a Legacy Fund or immediate funding through a Flow-Through Fund. We provide expertise on the gifting of many kinds of commodities and personal belongings, including:

We accept donations of cash, cheque, e-transfer, electronic transfer, or even credit card. While these options are convenient, typically these gifts are the least tax efficient way of donating and encourage you to explore other options.

Your publicly traded stocks (CDN or USD) or mutual funds can be donated to the Foundation. We offer this service now with zero fees into your fund! Substantial tax advantages exist with greater benefits than just donating cash.

The donation of your mutual funds, RRSPs, or RRIFs can be coordinated with no fees. You receive a tax receipt for the full market value.

The donation of preferred shares could increase your tax benefits of up to 16% over donating cash from dividends. Even more powerful can be the use of life insurance through your business backing those preferred share donations.

Homes, cottages, rental properties, and more can all be coordinated through the Community Foundation.

You can donate your mineral rights, receive a tax receipt of the market value, and we can hold your mineral rights in honour of your family legacy forever. For over a decade, we have managed over $2 million in mineral rights, and the royalties earned each year go to the families’ funds.

Did you know a Will can be contested through the courts? In Saskatchewan, a Will that has gone through probate is publicly available. Through a Charitable Remainder Trust, assets such as homes, cars, RRSP, etc. are donated into it, you receive a tax receipt for the market value, and then during your lifetime you can still use those assets. Once you pass, the assets skip the probate and estate process and are transferred to the Foundation to then honour your life well-lived.

Vehicles, works of art, or basically any other asset can be donated to the Foundation. Give us a call to discuss further and we can chat about options and how we can make the process seamless.

Speak with our Donation Expert today!

Shauna Reiger -

Finance and Fund Officer

Speak with our Giving Expert today!

Shauna Reiger -

Finance and Fund Officer

Speak with our Giving Expert today!

Additional Resources

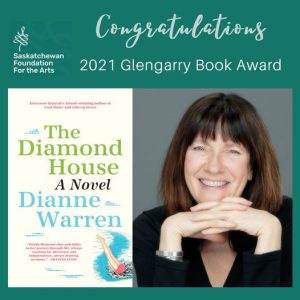

Leaving your Legacy Gift within your Will has never been easier

I've Left a Bequest in My Will, What's Next?

I've Left a Bequest in My Will, What's Next?

Our Legacy Circle recognizes current and future donors whose generosity and foresight will ensure that the Foundation will flourish for years to come. Joining our Legacy Circle ensures that your name will live on and your gift will create a lasting impact for generations. Click below to learn more about how we recognize the generous donors who have included the Community Foundation within their Will.

I've Left a Bequest in My Will, What's Next?

I've Left a Bequest in My Will, What's Next?

Our Legacy Circle recognizes current and future donors whose generosity and foresight will ensure that the Foundation will flourish for years to come. Joining our Legacy Circle ensures that your name will live on and your gift will create a lasting impact for generations. Click below to learn more about how we recognize the generous donors who have included the Community Foundation within their Will.

More Information

Your Legacy Forever

Maximize Your Donations

How to Donate

If you have any questions on how we can help make the most of your impact, please feel free to reach out to our Giving expert!

Stay Connected

Sign up for our newsletter today to ensure you never miss an opportunity to engage with the community. We will send you updates on how the community is fairing with our Vital Signs Reports, upcoming events to participate in, as well as our Newsletters released bi-annually.